Mysterious $36.29 e-Transfer from MNP? Why Facebook Sent You: This sounds fishy, right? This article digs into a puzzling situation: an unexpected $36.29 e-transfer seemingly linked to Facebook. We’ll explore potential explanations, from innocent mistakes to elaborate scams, and equip you with the knowledge to protect yourself.

We’ll unravel the mystery behind the sender, “MNP,” investigate possible connections to Facebook, analyze the oddly specific amount, and provide a step-by-step guide on how to handle this type of situation. Whether it’s a simple error or something more sinister, understanding the possibilities is your best defense.

Understanding Mysterious E-Transfers

Receiving an unexpected e-transfer, especially from an unknown sender like “MNP,” can be unsettling. This guide provides a structured approach to investigating such situations, focusing on identifying potential risks and developing a safe response strategy. Understanding the characteristics of legitimate and fraudulent e-transfers is crucial for determining the next steps.

Legitimate E-Transfer Characteristics

Legitimate e-transfers typically originate from known senders, often with a clear and recognizable reason for the transaction. The amount transferred usually aligns with expected payments or refunds. The sender’s information, including name and contact details, is readily available and verifiable. You should always expect a clear communication trail preceding or accompanying the transfer.

Reasons for Unexpected Funds

Receiving unexpected funds can stem from various legitimate sources, such as an overpayment from a vendor, a delayed or duplicate payment from an employer, or a mistaken transfer from a friend or family member. However, it’s crucial to verify the source before assuming legitimacy.

Reporting Suspicious E-Transfers

If you suspect fraudulent activity, immediately contact your financial institution. Provide them with all relevant details, including the transaction ID, sender’s information (if available), and the amount transferred. They will guide you through the process of reporting the suspicious activity and initiating an investigation.

Examples of Fraudulent E-Transfer Scenarios

Fraudulent e-transfers often involve phishing scams, where recipients are tricked into revealing their banking details. Another common scenario is a bait-and-switch tactic, where a seemingly legitimate transaction turns out to be a fraudulent scheme. Some scams involve small test amounts like $36.29 to see if the recipient will engage before larger amounts are attempted.

Comparison of Legitimate and Fraudulent E-Transfers

| Characteristic | Legitimate Transfer | Fraudulent Transfer |

|---|---|---|

| Sender | Known and verifiable | Unknown or suspicious |

| Amount | Expected and consistent with prior transactions | Unexpected or unusually small |

| Reason | Clearly stated and verifiable | Unclear or suspicious |

| Communication | Clear communication trail before or after transfer | Lack of communication or suspicious communication |

Investigating MNP (the Sender)

The sender’s abbreviation, “MNP,” requires further investigation. Understanding potential meanings and online associations is crucial to determining the transfer’s legitimacy.

Potential Meanings of “MNP”

“MNP” could stand for various things, depending on the context. It might be an abbreviation used internally by a company, a shortened version of a name, or even a random string of characters. Thorough online research is needed to eliminate possibilities.

Online Research for “MNP” and Suspicious Activity

Conducting a comprehensive online search for “MNP” in conjunction with terms like “fraud,” “scam,” or “e-transfer” can reveal any known associations with suspicious financial activity. Checking social media and online forums can provide additional insights.

Implications of an Unknown Sender

An unknown sender immediately raises red flags. It’s essential to exercise caution and avoid any actions that might compromise personal financial information. Contacting your financial institution is the safest course of action.

Tracing the Origin of an E-Transfer

Tracing the origin of an e-transfer can be challenging without specific details. However, working with your financial institution and providing them with all available information can aid in tracing the source of the funds.

Step-by-Step Guide to Researching an Unknown Sender

- Search online for “MNP” combined with terms like “e-transfer,” “fraud,” and “scam.”

- Check social media and online forums for mentions of “MNP” related to suspicious activity.

- Review your recent online activity for any potential connections to “MNP.”

- Contact your financial institution to report the suspicious transfer and request assistance in tracing the sender.

Exploring the Facebook Connection

The potential link between Facebook and the e-transfer needs careful consideration. Understanding possible scenarios and Facebook’s security measures is vital in determining the nature of the transaction.

Potential Reasons for Facebook Association, Mysterious .29 e-Transfer from MNP? Why Facebook Sent You

A Facebook connection might indicate a phishing scam, where a compromised account was used to initiate the transfer. It could also be related to a fraudulent advertisement or a compromised app on the platform.

Scenarios Involving Facebook and Fraudulent Transactions

Fraudsters might use compromised Facebook accounts to send phishing messages containing links to fake websites that steal banking information. They might also create fake advertisements or apps to collect sensitive data.

Facebook’s Security Measures

Facebook employs various security measures, including two-factor authentication and account monitoring systems. However, no system is foolproof, and fraudsters constantly develop new methods to circumvent security protocols.

Examples of Facebook-Related Online Fraud

Examples include phishing emails mimicking Facebook notifications, fake login pages designed to steal credentials, and malicious apps that collect user data without consent. These scams often target users’ trust in the Facebook platform.

Steps to Take if You Suspect Facebook Involvement

- Review your Facebook account for any suspicious activity, including unauthorized logins or unfamiliar apps.

- Change your Facebook password and enable two-factor authentication.

- Report any suspicious messages or accounts to Facebook.

- Contact your financial institution to report the suspicious transfer.

Analyzing the $36.29 Amount

The seemingly insignificant amount of $36.29 might hold clues to the nature of the transaction. Analyzing this specific amount and comparing it to other known fraudulent transactions can shed light on the sender’s intentions.

Significance of the $36.29 Amount

Small, seemingly random amounts like $36.29 are often used in test transactions to check if a recipient’s account is active and able to receive funds before larger amounts are attempted. This minimizes risk for the fraudster.

Reasons for Choosing This Amount

Fraudsters might choose unusual amounts to avoid detection. The amount might be deliberately chosen to appear less suspicious than larger amounts that might trigger alerts.

Comparison to Other Fraudulent Transaction Amounts

While there’s no definitive database of fraudulent transaction amounts, similar small, unusual amounts have been reported in various phishing and scam attempts.

Patterns in Seemingly Random Amounts

Fraudsters often use seemingly random amounts to avoid patterns that might raise red flags. However, analyzing a large dataset of fraudulent transactions might reveal some underlying patterns.

Potential Explanations for the Unusual Amount

- Test transaction to check account activity.

- Part of a larger scam involving multiple smaller transactions.

- A deliberate attempt to appear less suspicious.

- A simple mistake or error in a legitimate transaction.

Developing a Response Strategy

A structured response strategy is crucial when dealing with an unexpected e-transfer. This involves securing personal information, contacting relevant authorities, and documenting all interactions.

That weird $36.29 e-transfer from MNP? It’s probably not aliens, but figuring out who sent it can be a puzzle. Completely unrelated, but sad news broke today: Sportscaster Greg Gumbel dies from cancer at age 82. Back to the mystery money – check your Facebook payment activity; sometimes those notifications get buried. Maybe it’s a refund?

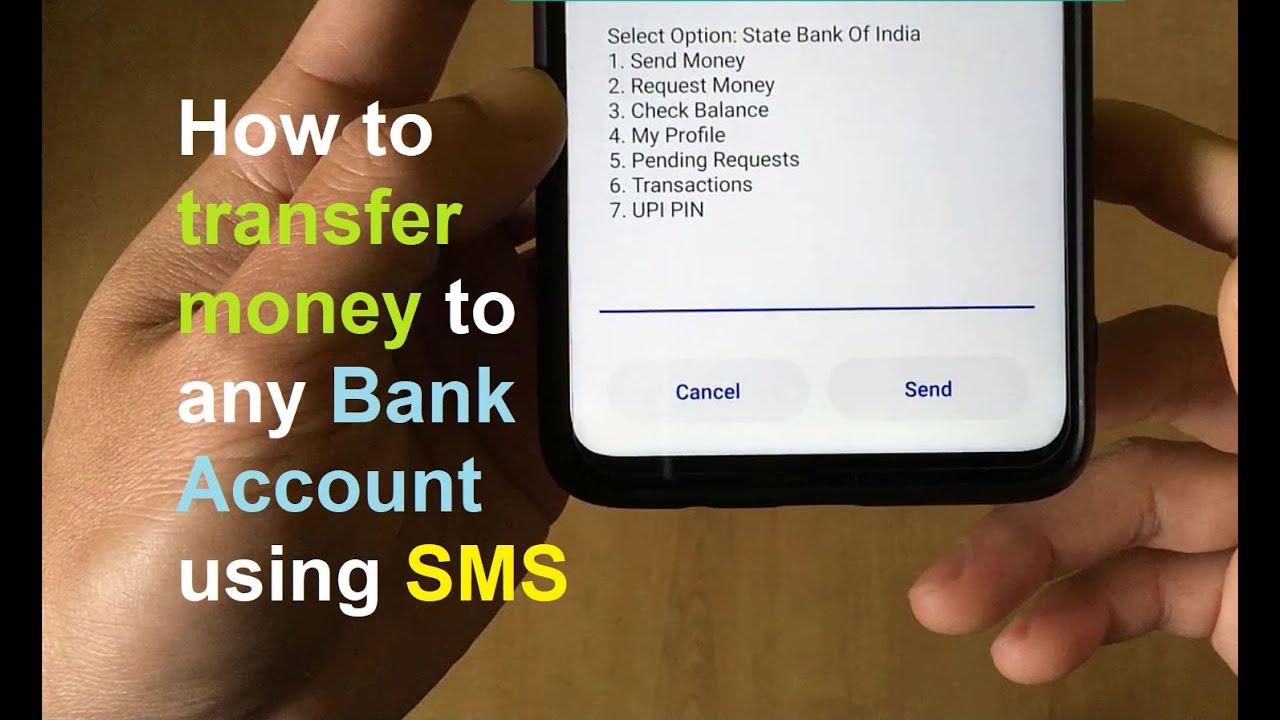

Plan for Responding to the Unexpected E-Transfer

The first step is to remain calm and avoid taking any rash actions. Thoroughly investigate the sender and the transaction details before responding. Contact your financial institution immediately to report the suspicious activity.

So, you got a mysterious $36.29 e-transfer from MNP? Thinking it’s a Facebook glitch? It’s definitely weird, but honestly, sometimes life throws curveballs. For example, sad news broke today about the passing of a broadcasting legend; check out this article about Sportscaster Greg Gumbel dies from cancer at age 78. Anyway, back to your mystery money – maybe contact MNP directly to figure out what’s up with that transfer.

Securing Personal Financial Information

Review your bank statements for any unauthorized transactions. Change your online banking passwords and consider enabling two-factor authentication. Monitor your credit report for any suspicious activity.

Contacting Authorities

If you suspect fraud, contact your local law enforcement agency and report the incident. Provide them with all relevant information, including transaction details and any communication with the sender.

Communication Strategies with Financial Institutions

Communicate clearly and concisely with your bank, providing all necessary details about the transaction. Keep records of all communications, including dates, times, and names of individuals you spoke with.

Documenting Interactions

Maintain a detailed record of all interactions related to the suspicious transaction, including emails, phone calls, and any written correspondence with your bank and law enforcement.

Illustrating Potential Scenarios

Several scenarios can explain the mysterious e-transfer. Understanding these possibilities helps in determining the appropriate course of action.

Legitimate E-Transfer Scenario

A legitimate scenario might involve a delayed refund from a vendor. The vendor, using a less familiar payment method or internal system abbreviation (“MNP”), might have accidentally sent the funds late. The small amount could be a partial refund or a portion of a larger payment.

Phishing Scam Scenario

A phishing scam might involve a deceptive email or message from a fraudster impersonating a legitimate entity. The $36.29 could be a test transaction to see if the recipient’s account is functional, followed by larger withdrawals if successful.

Compromised Facebook Account Scenario

A compromised Facebook account could have been used to send the e-transfer as part of a wider scam. The fraudster might have gained access to the victim’s financial information through various methods such as phishing, malware or social engineering.

Refund or Payment Error Scenario

A simple error by a legitimate company could result in an unexpected payment. Perhaps an automated system malfunctioned, resulting in an incorrect amount being sent. This is especially plausible with a small, unusual amount.

Reporting the Transaction to the Bank

Imagine a user sitting at their computer, carefully documenting the transaction details – the date, time, amount ($36.29), sender (“MNP”), and any accompanying communication. They then navigate to their bank’s online portal or dial their customer service number. They calmly and clearly explain the situation, providing all the documented information to the bank representative, who assures them that an investigation will be launched.

The user meticulously records the representative’s name, the time of the call, and the reference number assigned to the case.

Wrap-Up

So, did Facebook really send you $36.29? Probably not directly. This situation highlights the importance of vigilance when it comes to unexpected online transactions. By understanding the red flags of potential scams and following the steps Artikeld here, you can protect yourself from financial fraud and confidently navigate similar situations. Remember, when in doubt, contact your bank immediately.

User Queries: Mysterious .29 E-Transfer From MNP? Why Facebook Sent You

What does MNP stand for?

There’s no single definitive answer. “MNP” could be an abbreviation used internally by a company, a shortened name, or even random letters. The key is the lack of clear identification.

So you got a mysterious $36.29 e-transfer from MNP? Think it’s Facebook? Maybe not. Sometimes life throws curveballs, like that goalless draw between Brighton and Brentford – check out the match report here: Brighton 0-0 Brentford: Julio Enciso misfires in stalemate at the Amex to see if that’s more exciting than your bank statement! Anyway, back to that e-transfer – double-check your recent online activity and contact MNP directly if you’re still puzzled.

Should I spend the money?

Absolutely not! Treat any unexpected funds as potentially fraudulent until proven otherwise. Spending it could complicate things significantly.

What if the transfer was a legitimate mistake?

Contact your bank and the sender (if possible) to clarify. They’ll guide you through the return process if it’s an error.

How do I report this to Facebook?

Report it through Facebook’s help center or report the suspicious activity to your local authorities.